Man Dies After His Wife Set His Genitals On Fire For Cheating.This lady burn down a Million Dollar house and sets her husband Manhood on fire....WOW...WOW...

The American Gangster By Louis Farrakhan

Must listen to this real talk!!!!

Tuesday, December 30, 2008

Louis Farrakhan,

Posted by

MRENTERTAINMENT

at

9:14 AM

0

comments

![]()

![]()

Saturday, December 27, 2008

Wednesday, December 24, 2008

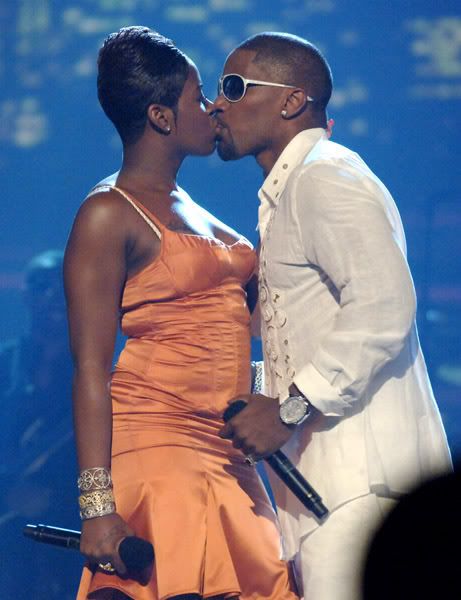

XMAS EVE!!!-Nelly,Can I Buy You A Drink?,

World's Oldest Cognac for $6,000 a Shot

The luxe Lanesborough Hotel in London has just acquired the world's oldest bottle of cognac, distilled in 1770, and is offering it to patrons of their plush Library Bar (above) for £4,000, or about $6,000, per shot. That's considerably more than the ultra-expensive Louis XIII Black Pearl Magnum cognac my colleague Lisa Palladino wrote about last summer, which cost $2,500 per shot. In addition to the 240-year-old tipple, the Lanesborough, a St. Regis property, just installed a new walk-in cigar humidor, the first of its kind in a London hotel. The humidor houses 1,000 cigars and contains 25 private lockers for the personal collections of top patrons, who can enjoy Cuban and even pre-Castro smokes in the hotel's posh Garden Room.

[via JustLuxe]

Sources say that Nelly likes it and wants to put a ring on it, but Ashanti’s mom-ager is c*ckblocking all the time.

“Tina sticks her nose in everything because she’s also Ashanti’s manager...She’s always pushing Ashanti to make more money, to always look great. It stresses her out, and Nelly doesn’t like that..."Before he makes her his wife,” adds the source, “Nelly wants to know that Ashanti can make decisions on her own.

If Ashanti knows what's up, she will put that independent act together real quick, because no dude wants a chick that's still hanging off her moms' melons.

I need the money????

Guy Breaks His Leg!!!!!!!!

Merry X-Mas

Posted by

MRENTERTAINMENT

at

8:38 AM

0

comments

![]()

![]()

Tuesday, December 23, 2008

Oprah Moving To D.C.???

Oprah the talk show titan is reportedly looking at ultra-luxury properties in Washington, DC; something suitable for, say, possible consultations with the President of the United States.

Insiders tell the New York Post that Winfrey's people have been scouting a nine-bedroom mansion in D.C.'s swanky Georgetown neighborhood with a whopping price tag of $50 million.

"She has never personally been to see it," another source tells the paper.

But FOXNews.com has researched listings in the area and found a single house that fits that description: a $49 million, nine-bedroom, four-bathroom mansion on three-and-a-half acres with parking for 100 cars, a gatehouse, and an additional building overlooking the Washington monument.

In case of parties..

Posted by

MRENTERTAINMENT

at

11:42 PM

0

comments

![]()

![]()

Monday, December 22, 2008

LAMAR'S BIRTHDAY WEEKEND

This is a recap of the weekend...One of my best Birthday party weekends in years.

Friday hit Club Love which is my All-Time favorite party spot in the world...Sat we hit Club Lux which was a smaller version of Love and it was cool..Parking was not the best...

Sunday we had Dinner at one of Washington D.C.'s premier restaurants for over 20 years. Located in the heart of historic Georgetown, Filomena Ristorante offers outstanding Italian cuisine and elegant atmosphere.Very nice spot voted number

one Italian Restaurant in the DMV.

P.S. Thanks to my all time two best party people in the world.Shanda and Che AKA "RED BULL"..

Check out a few pics..

Posted by

MRENTERTAINMENT

at

10:51 AM

0

comments

![]()

![]()

Sunday, December 21, 2008

BMF,P Diddy-J-LO,Jamie Foxx

J-LO

The word is that J-Lo’s four year marriage to Marc Anthony may be on the rocks as she's been seen gallivanting around Los Angeles' social scene without her wedding ring. Marc has been spotted out and about flirting with other women and talking smack about marital misery…ringless as well.

Insiders say she is becoming increasingly frustrated with Marc’s “controlling” nature - he insists on picking her clothes and checks up on all her phone calls. Anthony has denied the rumors and says that their marriage is doing just fine….hmmmm we’ve all heard that before.

I am sure P Diddy waiting in the wings in his Sunday's best for this break up..

Stripper Down!!!

FLASHBACK INTERVIEW JAMIE FOXX-SUPERHEAD!!!!!!!!!!!WOW !!

Posted by

MRENTERTAINMENT

at

10:59 AM

0

comments

![]()

![]()

Saturday, December 20, 2008

Posted by

MRENTERTAINMENT

at

8:43 PM

0

comments

![]()

![]()

Friday, December 19, 2008

Sunday, December 14, 2008

Michael-Vick-R_0[1]

By ALAN JUDD

The Atlanta Journal-Constitution

Saturday, December 06, 2008

The day he went to jail, Michael Vick bought a $99,000 Mercedes.

RELATED STORIES

Records show how Vick burned through fortune

Vick enters guilty plea, gets suspended sentence

Vick to enter guilty plea in Va. court Tuesday

Vick back in Virginia to face state charges

He cashed four checks that totaled $24,900. He gave $28,000 to the mother of his oldest child. He paid a public relations firm $23,000 and gave a friend $16,000.

Altogether on Nov. 19, 2007, Vick spent $201,840. But for the former Atlanta Falcons quarterback, the day was most remarkable for how it ended: behind bars, beginning what would be a nearly two-year sentence in a notorious dogfighting case.

The day’s spending, in fact, was but a small part of the $18.2 million that flew out of Vick’s hands from 2006 to 2008, according to documents filed recently in U.S. Bankruptcy Court in Norfolk, Va. Nearing the end of his time in federal prison, Vick, 28, is seeking the court’s protection from his creditors.

They are particularly interested in his increased spending in the three months before he reported for jail.

The documents provide a detailed look at the privileged lifestyle of an athlete who rarely offered more than a glimpse of himself off the playing field. They show how Vick, who grew up poor in Newport News, Va., bought houses and cars, farms and horses, boats and jewelry, all at the height of a spectacular career that shattered after he was identified as the key figure in an illegal dogfighting ring.

The bankruptcy filings also reveal Vick at his most vulnerable. Financial advisers, Vick’s lawyers claim, took advantage of him. He poured money into businesses that failed. He took care of the needs of his relatives, paying for satellite television and cellphone service, for instance, and his mother’s offerings to her church. He even gave each of his three co-defendants in the dogfighting case $150,000 for legal bills.

For his own expenses, Vick seems to have relied heavily on cash.

In 2007, documents show, he used cashier’s checks to withdraw $908,500 from his bank accounts. During a two-year period, he wrote checks payable to “cash” totaling almost $1.1 million.

His spending escalated as his prison sentence neared.

From Aug. 27, 2007, the day he pleaded guilty in a Richmond federal courthouse, until Nov. 19, the day he bought the new Mercedes before reporting to jail, Vick shelled out $3,627,291.

Those transactions are “of special interest” to groups seeking repayment from Vick, said attorney Ross Reeves of Norfolk, who represents unsecured creditors, including the Falcons. The team wants Vick to return $3.75 million from a 2004 bonus.

“Where did these assets go and for what purpose?” Reeves said in an interview. “A lot of what Mike Vick was doing was planning for being incarcerated. He wanted to provide for his family, and he made that clear.”

At the same time, Reeves said, creditors want to make sure Vick wasn’t “sheltering assets.”

Lawyers for Vick declined to comment.

Whatever the case, everything Vick had may be gone. And resuming his old life when he gets out of prison next year seems a long shot.

Vick is banned from the National Football League. Once the game’s highest-paid player, Vick now claims only a nominal monthly income from an investment account: $12.89.

‘World is mine’

Not long after joining the Falcons, Vick bought his first house: a $918,000 mini-mansion behind the gates that guard the Sugarloaf Country Club in Duluth. Two years later, in April 2005, he upgraded to a larger house in the same neighborhood, for almost $3.8 million. Among his improvements to that property: a movie screening room and a golf simulator.

Vick had money to burn. In 2004, after two seasons with the Falcons, he signed a new contract that, with potential bonuses, could pay him $130 million by 2013. Endorsement deals — with Nike, AirTran Airways and others — added millions more. In 2006 and 2007 alone, Vick took in almost $22 million.

So, court records show, Vick went shopping.

He bought four more houses, all in Virginia, and began building another.

He bought a condominium in Miami Beach.

He bought interests in two farms — one in Virginia, one in Rockdale County, east of Atlanta.

He bought six Paso Fino horses, worth about $450,000.

He bought two boats, one for $100,000, the other for $125,000.

He bought cars: a Bentley, two Land Rovers, Cadillacs, an Infiniti sport utility vehicle and an Infiniti sedan, two Ford pickup trucks, a Dodge, a Chevrolet, the $99,000 Mercedes.

And he bought as much as $450,000 in jewelry. The pieces included two Swiss watches, a bracelet, a pair of diamond stud earrings, and a charm inscribed, “World is mine.”

Vick shared with family and friends and with family of friends.

In 2006, for instance, he bought his sister, Christina, a GMC Yukon. The next year, he gave a Lincoln Navigator to Tameka Taylor, the mother of his first child. The mother of Vick’s other two children, Kijafa Frink, got a Land Rover; her mother, a Cadillac Escalade.

Vick also took on recurring obligations. He paid Frink’s mortgage and gave her $1,000 a month for clothes, court records say, and $300 for “beauty-related expenses.” He supported Taylor and their son with $3,500 a month.

For his mother, Brenda Boddie, Vick covered a $4,700-a-month mortgage and $2,100 in payments for her two Cadillacs.

In all, routine monthly bills for the mothers of Vick’s children and for his own mother came to $31,293 — more than $375,000 a year.

Unlucky 7?

To run his complicated financial life, Vick in 2005 created a management and marketing company, MV7 LLC. It provided income for at least two family members, according to public records: Vick’s mother, whose salary approached $100,000 a year, and his sister, who earned about $22,000. The firm even had a retirement fund.

MV7 was the first of several ventures that alluded to one or both of Vick’s most valuable assets: his name and his jersey number.

Divine Seven operated a Payless Car Rental franchise at the Atlanta airport. Seven Charms Farm raised horses. Vicktory Corp. oversaw family investments. Siete (Spanish for “seven”) delivered a gift of $317,000 to his mother’s church a week before Vick pleaded guilty.

Bad luck plagued many of Vick’s enterprises.

In 2006, Vick personally guaranteed a $2.1 million bank loan to Divine Seven in exchange for a 60 percent stake in the company. A little over a year later, the bank declared the loan in default. It obtained a civil judgment against Vick and is trying to collect through his bankruptcy case.

In 2007, Vick put up $200,000 for a 60 percent interest in Seven Charms Farm, a 5-acre spread near Conyers. In September of this year, Rockdale County sold the property at auction to satisfy an unpaid property tax bill. The buyer got the property for $40,000.

Vick’s philanthropic efforts didn’t fare especially well, either. In 2006, the Michael Vick Foundation provided 100 backpacks to poor children in Newport News and paid for an after-school program. But the foundation spent only 12 percent of its budget — $20,590 of $171,823 — on charitable programs, according to its 2006 federal tax return. The foundation paid its fund-raiser, Susan Bass Roberts, a former spokeswoman for Vick, $97,000, the tax return shows.

Most of the foundation’s money came from Vick, Roberts said in an interview. But she declined to speak in detail about the foundation, which she described as “kind of like ancient history.”

The foundation ceased operations in 2006.

Most of the money left in the foundation’s bank account, $50,000, was withdrawn earlier this year by one of the succession of financial advisers Vick hired, court records say. Several advisers and business partners took money or other assets without Vick’s approval, his lawyers told the bankruptcy court, adding that they may file lawsuits to recoup some of his losses. Vick’s former associates have denied the allegations.

Perhaps Vick’s most successful company was the one that precipitated his fall from grace.

Mike Vick Kennels LLC bred and sold pit bulls – and, Vick ultimately admitted in court, staged and participated in illegal dogfights.

A last spree

After a highly publicized investigation that lasted several weeks, a federal grand jury indicted Vick on dogfighting charges on July 17, 2007. He pleaded guilty before U.S. District Judge Henry Hudson five weeks later, on Aug. 27, in Richmond. Hudson let Vick remain free on bond until a hearing on his sentence, scheduled three months out.

Thus began Vick’s last spending spree.

He began by setting aside money for family members. He put $625,000 into two businesses that would make monthly payments to Frink, who then was pregnant with their second child. He also gave Frink $48,000 and an SUV to keep in Leavenworth, Kan., where he would serve his sentence.

During his last weeks of freedom, though, Vick also spent $85,000 on a fish pond and $48,257 for landscaping. He bought a $31,000 Ford pickup and a $33,100 Chevrolet.

Vick’s financial records suggest he was hemorrhaging money. In the weeks before he went to jail, he made 48 cash withdrawals for a total of $325,945. The largest was on Sept. 19, for about $67,000. Using three cashier’s checks, he withdrew an additional $90,000.

Court documents do not reflect how Vick used the cash.

Finally, on Nov. 19, Vick went to a car showroom in Hampton, Va. He picked out an andorite-gray 2008 Mercedes-Benz S550 sedan and, using his bank debit card, paid in full: $99,589.71.

Then he drove to Richmond, surrendered to federal marshals and went to jail.

The Mercedes now is in the hands of a group of creditors; they recently told a bankruptcy judge they have found a buyer willing to pay $65,000. A luxury-car broker is trying to sell the rest of Vick’s vehicles.

Under bankruptcy laws, Vick will be allowed to retain ownership of one house; he chose his mother’s home in Suffolk, Va. He also is keeping $136,500 of home furnishings, $5,000 of clothes and a retirement account with a balance of $96.63.

Vick’s other houses are on the market. The proceeds of any sales would go toward paying off the mortgages.

Repaying other creditors might be a challenge, especially if his suspension from professional football continues after his prison term.

In addition to his other debts, Vick owes more than $1.2 million in back taxes, the Internal Revenue Service told his bankruptcy judge last month. That figure may increase, the IRS said in court papers; Vick has not yet filed his 2007 return.

Still, Vick’s court papers sound an upbeat note.

After prison, his lawyers wrote last month, Vick “will return to Virginia and will seek to rebuild his life and his career.”

Vick, they wrote, has “every reason to believe that upon his release, he will be reinstated into the NFL, resume his career and be able to earn a substantial living.”

Posted by

MRENTERTAINMENT

at

10:41 PM

0

comments

![]()

![]()

Mike Vick Was Ballin!!!!!!!!!!!!!!

Records show how Vick burned through fortune

By ALAN JUDD

The Atlanta Journal-Constitution

Saturday, December 06, 2008

The day he went to jail, Michael Vick bought a $99,000 Mercedes.

RELATED STORIES

Records show how Vick burned through fortune

Vick enters guilty plea, gets suspended sentence

Vick to enter guilty plea in Va. court Tuesday

Vick back in Virginia to face state charges

He cashed four checks that totaled $24,900. He gave $28,000 to the mother of his oldest child. He paid a public relations firm $23,000 and gave a friend $16,000.

Altogether on Nov. 19, 2007, Vick spent $201,840. But for the former Atlanta Falcons quarterback, the day was most remarkable for how it ended: behind bars, beginning what would be a nearly two-year sentence in a notorious dogfighting case.

The day’s spending, in fact, was but a small part of the $18.2 million that flew out of Vick’s hands from 2006 to 2008, according to documents filed recently in U.S. Bankruptcy Court in Norfolk, Va. Nearing the end of his time in federal prison, Vick, 28, is seeking the court’s protection from his creditors.

They are particularly interested in his increased spending in the three months before he reported for jail.

The documents provide a detailed look at the privileged lifestyle of an athlete who rarely offered more than a glimpse of himself off the playing field. They show how Vick, who grew up poor in Newport News, Va., bought houses and cars, farms and horses, boats and jewelry, all at the height of a spectacular career that shattered after he was identified as the key figure in an illegal dogfighting ring.

The bankruptcy filings also reveal Vick at his most vulnerable. Financial advisers, Vick’s lawyers claim, took advantage of him. He poured money into businesses that failed. He took care of the needs of his relatives, paying for satellite television and cellphone service, for instance, and his mother’s offerings to her church. He even gave each of his three co-defendants in the dogfighting case $150,000 for legal bills.

For his own expenses, Vick seems to have relied heavily on cash.

In 2007, documents show, he used cashier’s checks to withdraw $908,500 from his bank accounts. During a two-year period, he wrote checks payable to “cash” totaling almost $1.1 million.

His spending escalated as his prison sentence neared.

From Aug. 27, 2007, the day he pleaded guilty in a Richmond federal courthouse, until Nov. 19, the day he bought the new Mercedes before reporting to jail, Vick shelled out $3,627,291.

Those transactions are “of special interest” to groups seeking repayment from Vick, said attorney Ross Reeves of Norfolk, who represents unsecured creditors, including the Falcons. The team wants Vick to return $3.75 million from a 2004 bonus.

“Where did these assets go and for what purpose?” Reeves said in an interview. “A lot of what Mike Vick was doing was planning for being incarcerated. He wanted to provide for his family, and he made that clear.”

At the same time, Reeves said, creditors want to make sure Vick wasn’t “sheltering assets.”

Lawyers for Vick declined to comment.

Whatever the case, everything Vick had may be gone. And resuming his old life when he gets out of prison next year seems a long shot.

Vick is banned from the National Football League. Once the game’s highest-paid player, Vick now claims only a nominal monthly income from an investment account: $12.89.

‘World is mine’

Not long after joining the Falcons, Vick bought his first house: a $918,000 mini-mansion behind the gates that guard the Sugarloaf Country Club in Duluth. Two years later, in April 2005, he upgraded to a larger house in the same neighborhood, for almost $3.8 million. Among his improvements to that property: a movie screening room and a golf simulator.

Vick had money to burn. In 2004, after two seasons with the Falcons, he signed a new contract that, with potential bonuses, could pay him $130 million by 2013. Endorsement deals — with Nike, AirTran Airways and others — added millions more. In 2006 and 2007 alone, Vick took in almost $22 million.

So, court records show, Vick went shopping.

He bought four more houses, all in Virginia, and began building another.

He bought a condominium in Miami Beach.

He bought interests in two farms — one in Virginia, one in Rockdale County, east of Atlanta.

He bought six Paso Fino horses, worth about $450,000.

He bought two boats, one for $100,000, the other for $125,000.

He bought cars: a Bentley, two Land Rovers, Cadillacs, an Infiniti sport utility vehicle and an Infiniti sedan, two Ford pickup trucks, a Dodge, a Chevrolet, the $99,000 Mercedes.

And he bought as much as $450,000 in jewelry. The pieces included two Swiss watches, a bracelet, a pair of diamond stud earrings, and a charm inscribed, “World is mine.”

Vick shared with family and friends and with family of friends.

In 2006, for instance, he bought his sister, Christina, a GMC Yukon. The next year, he gave a Lincoln Navigator to Tameka Taylor, the mother of his first child. The mother of Vick’s other two children, Kijafa Frink, got a Land Rover; her mother, a Cadillac Escalade.

Vick also took on recurring obligations. He paid Frink’s mortgage and gave her $1,000 a month for clothes, court records say, and $300 for “beauty-related expenses.” He supported Taylor and their son with $3,500 a month.

For his mother, Brenda Boddie, Vick covered a $4,700-a-month mortgage and $2,100 in payments for her two Cadillacs.

In all, routine monthly bills for the mothers of Vick’s children and for his own mother came to $31,293 — more than $375,000 a year.

Unlucky 7?

To run his complicated financial life, Vick in 2005 created a management and marketing company, MV7 LLC. It provided income for at least two family members, according to public records: Vick’s mother, whose salary approached $100,000 a year, and his sister, who earned about $22,000. The firm even had a retirement fund.

MV7 was the first of several ventures that alluded to one or both of Vick’s most valuable assets: his name and his jersey number.

Divine Seven operated a Payless Car Rental franchise at the Atlanta airport. Seven Charms Farm raised horses. Vicktory Corp. oversaw family investments. Siete (Spanish for “seven”) delivered a gift of $317,000 to his mother’s church a week before Vick pleaded guilty.

Bad luck plagued many of Vick’s enterprises.

In 2006, Vick personally guaranteed a $2.1 million bank loan to Divine Seven in exchange for a 60 percent stake in the company. A little over a year later, the bank declared the loan in default. It obtained a civil judgment against Vick and is trying to collect through his bankruptcy case.

In 2007, Vick put up $200,000 for a 60 percent interest in Seven Charms Farm, a 5-acre spread near Conyers. In September of this year, Rockdale County sold the property at auction to satisfy an unpaid property tax bill. The buyer got the property for $40,000.

Vick’s philanthropic efforts didn’t fare especially well, either. In 2006, the Michael Vick Foundation provided 100 backpacks to poor children in Newport News and paid for an after-school program. But the foundation spent only 12 percent of its budget — $20,590 of $171,823 — on charitable programs, according to its 2006 federal tax return. The foundation paid its fund-raiser, Susan Bass Roberts, a former spokeswoman for Vick, $97,000, the tax return shows.

Most of the foundation’s money came from Vick, Roberts said in an interview. But she declined to speak in detail about the foundation, which she described as “kind of like ancient history.”

The foundation ceased operations in 2006.

Most of the money left in the foundation’s bank account, $50,000, was withdrawn earlier this year by one of the succession of financial advisers Vick hired, court records say. Several advisers and business partners took money or other assets without Vick’s approval, his lawyers told the bankruptcy court, adding that they may file lawsuits to recoup some of his losses. Vick’s former associates have denied the allegations.

Perhaps Vick’s most successful company was the one that precipitated his fall from grace.

Mike Vick Kennels LLC bred and sold pit bulls – and, Vick ultimately admitted in court, staged and participated in illegal dogfights.

A last spree

After a highly publicized investigation that lasted several weeks, a federal grand jury indicted Vick on dogfighting charges on July 17, 2007. He pleaded guilty before U.S. District Judge Henry Hudson five weeks later, on Aug. 27, in Richmond. Hudson let Vick remain free on bond until a hearing on his sentence, scheduled three months out.

Thus began Vick’s last spending spree.

He began by setting aside money for family members. He put $625,000 into two businesses that would make monthly payments to Frink, who then was pregnant with their second child. He also gave Frink $48,000 and an SUV to keep in Leavenworth, Kan., where he would serve his sentence.

During his last weeks of freedom, though, Vick also spent $85,000 on a fish pond and $48,257 for landscaping. He bought a $31,000 Ford pickup and a $33,100 Chevrolet.

Vick’s financial records suggest he was hemorrhaging money. In the weeks before he went to jail, he made 48 cash withdrawals for a total of $325,945. The largest was on Sept. 19, for about $67,000. Using three cashier’s checks, he withdrew an additional $90,000.

Court documents do not reflect how Vick used the cash.

Finally, on Nov. 19, Vick went to a car showroom in Hampton, Va. He picked out an andorite-gray 2008 Mercedes-Benz S550 sedan and, using his bank debit card, paid in full: $99,589.71.

Then he drove to Richmond, surrendered to federal marshals and went to jail.

The Mercedes now is in the hands of a group of creditors; they recently told a bankruptcy judge they have found a buyer willing to pay $65,000. A luxury-car broker is trying to sell the rest of Vick’s vehicles.

Under bankruptcy laws, Vick will be allowed to retain ownership of one house; he chose his mother’s home in Suffolk, Va. He also is keeping $136,500 of home furnishings, $5,000 of clothes and a retirement account with a balance of $96.63.

Vick’s other houses are on the market. The proceeds of any sales would go toward paying off the mortgages.

Repaying other creditors might be a challenge, especially if his suspension from professional football continues after his prison term.

In addition to his other debts, Vick owes more than $1.2 million in back taxes, the Internal Revenue Service told his bankruptcy judge last month. That figure may increase, the IRS said in court papers; Vick has not yet filed his 2007 return.

Still, Vick’s court papers sound an upbeat note.

After prison, his lawyers wrote last month, Vick “will return to Virginia and will seek to rebuild his life and his career.”

Vick, they wrote, has “every reason to believe that upon his release, he will be reinstated into the NFL, resume his career and be able to earn a substantial living.”

Posted by

MRENTERTAINMENT

at

10:20 PM

0

comments

![]()

![]()

Friday, December 12, 2008

Tuesday, December 9, 2008

5 Supplements Your Body Needs

Multivitamins

You can make all the protein shakes you want, but if you're not getting the vitamins your body needs to build muscle and other tissue, then you're just wasting your time and money. Even if you think you’re eating right, you may not be getting all the nutrients you need from your diet. Food’s lack of vitamins and minerals can be caused right at the beginning with lackluster soil, poor storage and incorrect processing or cooking.

Overall, taking a daily multivitamin helps prevent a host of problems. For example, Mayo Clinic researchers recommend taking multivitamins to keep sperm healthy. Also, vitamin B controls the energy-level regulator cortisol, which is beneficial if you work in front of a computer all day. Multivitamins are also key to making other supplements work correctly.

Dosage: One multivitamin daily.

Selenium

This powerhouse mineral fights free radicals and, as a result, can be a key player in warding off cancer. Want proof? Research has found that men with high levels of this mineral were 48% less likely to contract advanced prostate cancer. Selenium can also help prevent lung cancer, as demonstrated by tests with groups of smokers taking the supplement. No, this doesn’t mean you’re allowed to put off quitting.

A recent Seattle-based study noted that taking multivitamins is important to supercharging selenium’s cancer-fighting power. This may be due to the fact that multivitamins contain at least 30 international units (IU) of vitamin E, which is the main selenium cofactor. Be sure to keep your ears open for new research developments with this specialized antioxidant, but in the meantime, take selenium for preventive measures.

Dosage: 40 to 70 micrograms (mcg) daily.

Folic acid

It’s not just for prenatal care guys; this B vitamin is a top-notch stroke preventative. At the micro level, it keeps your blood streaming instead of stopping. How? It dissolves homocysteine, a compound linked to heart disease and Alzheimer’s. Studies have shown that men taking large doses of folic acid were 30% less likely to suffer a stroke than those taking just a little.

But that’s not all folic acid does. Recent Dutch studies show that folic acid can increase cognitive function, even in older people. It also helps the body digest, use and synthesize the proteins that boost muscle growth. Folic acid is essential in the production of red blood cells and is helpful in improving energy levels and cardio performance. Finally, folic acid prevents heartburn and replaces lost nutrients in the body, all of which helps the digestive system work properly. You don’t need to overdose on the stuff to reap all the benefits; small amounts taken daily will make all the difference.

Dosage: 400 mcg daily.

Help increase your brain power and your bones

Acetyl-l-carnitine

Rather than helping with a six-pack, this amino acid gets your brain in shape. In fact, acetyl-L-carnitine could possibly slow down the effects of Alzheimer's. And, studies published by Proceedings of the National Academy of Sciences have also shown that rats that took acetyl-L-carnitine did better on memory tests. Why? It looks like carnitine declines in tissues with age, dulling the effectiveness of certain membranes. It’s particularly low in those who get Alzheimer’s. By giving your body the carnitine it’s missing, your mental function will improve, as well as cognition.

On a more fundamental level, Acetyl-L-carnitine is also key to helping the body store and produce energy, and we all know that having a good energy level is key to learning. As with all the other supplements, you don’t have to take a lot to get the maximum benefits. Just make sure your intake is consistent.

Dosage: 100 to 400 mg once daily.

Calcium

This mineral is a master multitasker that builds bones, aids in weight loss and possibly decreases the risk of colon cancer and cholesterol. Studies have found that 1,000 mg of calcium can increase your high-density lipoprotein cholesterol (a good cholesterol) by 7%. It has also been shown that in terms of bone health, calcium is particularly important for men who have already broken a bone. Calcium actually helps prevent you from suffering a break again.

Be sure to combine your calcium intake with vitamin D as directed. It’s just as critical in maintaining bone health and keeping your body healthy. Though sunlight is one of the best ways to get your vitamin D, Harvard researchers claim that north of 40-degrees latitude the sunlight isn’t strong enough to promote vitamin D formation. Recent (and wise) surges in the use of sunscreen also curb this type of vitamin sourcing. So reach for the supplements bottle on this one.

Dosage: 500 mg of calcium citrate with 125 IU of vitamin D twice daily.

Posted by

MRENTERTAINMENT

at

8:03 PM

0

comments

![]()

![]()

BOW SAY'S HE HAS MORE JORDANS THEN ANYBODY...NOT MARCUS JORDAN THOUGH!!

Posted by

MRENTERTAINMENT

at

3:15 PM

0

comments

![]()

![]()

Monday, November 17, 2008

Jan Events History In the Making

Date January 19, 2009

Time 8:30 p.m. - 1:30 a.m. (dinner begins 5:30 p.m.)

Place Renaissance Washington DC Hotel, 999 9th Street NW, Washington D.C.

Price $300 for ball; $500 for Gala VIP Reception, Dinner, and Ball

http://illinoisstatesociety.com/Gala2009.htm January 19, 2009 8:30-1:30

The Spirit of Hope Inaugural Ball

Date January 20, 2009

Time 9 p.m.

Place The Washington Club (Patterson House Mansion), 15 Dupont Circle, Washington D.C.

Price $125 single/$250 couple (by 11/30/08)

Attire Black tie

http://teninauguralball.eventbrite.com/

Independence Ball January 20, 2009

News and Information

The Independence Ball is one of the official inaugural balls, held after a president takes the oath of office.

In 2005, the ball was thrown in Hall A of the Convention Center, where five other balls were put on. The party was thrown on behalf of Colorado, Delaware, District of Columbia, Hawaii, Idaho, Iowa, Maryland, Massachusetts, Missouri, Nebraska, New Hampshire, Rhode Island, South Carolina, Vermont, Virginia and Washington.

The Guy Lombardo Orchestra, Funkiphino and The Wonders were on hand to entertain the guests. The event brought out around 6,000 people to celebrate the new administration.

Many of the tickets to the ball will be sent out by state lawmakers, but many tickets are left to score a spot in one of the biggest events in Washington society!

Patriot Ball January 20, 2009

News and Information

The Patriot Ball is one of several official balls to celebrate the inauguration of the President of the United States of America.

In 2005, the ball was held in Hall E of the Convention Center in Washington, DC, and was filled with lots of political folk from Ohio. While many people from outside of the state can be found at the ball, first dibs go to the residents of the state, as handed out by federal representatives.

The event included entertainment from the Dennis Samsa Orchestra and the Fabulous Fantoms. While the attendees were waiting to catch a glimpse of the new president and first lady, they dined on a variety of appetizers and had an opportunity to snap a picture in front of the presidential seal.

As soon as the cymbals clanged and Hail to the Chief is played, revelers from all over the country will rush to see the newly-sworn in leader, and you can be part of the fun!

Stars and Stripes Ball January 20, 2009

News and Information

The Stars and Stripes Ball is one of the premiere events in Washington, DC, on the evening of the Presidential Inauguration to celebrate the changing of hands in American politics.

The ball was thrown for the residents of New Jersey, New York and Pennsylvania in 2005, and was held in Ballroom ABC of the Convention Center. The Pat Dorn Orchestra, Colors and Doppleganger were all on hand to entertain the guests.

While federal representatives from the Mid Atlantic region were the ones giving out many of the tickets, residents from other states were also on hand for the fun. The event was the largest of all of the galas - it was one of six housed in the 2.3-million square foot, $855 million convention center.

The President makes an appearance at all of the official inaugural balls for a twirl around the dance floor, and tickets are available to get in on the action!

HBCU Inaugural Gala Ball

Date January 19, 2009

Time 8 p.m. - 1 a.m.

Place Sequoia at Washington Harbor, 3000 K Street NW, Washington D.C.

Price $200

Attire Black Tie

Notes This Black Tie Gala is to show support for Historically Black Colleges and Universities (HBCU). A portion of the proceeds will go towards charities that give scholarships to students currently attending HBCU's. If you are interested in purchasing tickets for this Gala please send an e-mail to hbcugala@gmail.com or www.hbcugala.com

**DC RESIDENTS: MAKE SOME $$$ renting your home**

Hey, have some extra room in your home or condo? Why not be of assistance to someone looking for a home and make a little $$$ at the same time. Visit http://obamabounddc.for/ more info! Tell em Curt sent ya

Posted by

MRENTERTAINMENT

at

9:39 PM

0

comments

![]()

![]()

Friday, November 14, 2008

OBAMA Has 7,000 positions to fill, Stated U.S. Government Printing Office's Plum Book

I am all about the upgrade..I wonder should I put my resume in the mix..There has to be a job for me out of 7000 jobs......I will keep you posted...

The whole app is listed below.

http://graphics8.nytimes.com/packages/pdf/national/13apply_questionnaire.pdf

If you want to work for President-elect Barack Obama's administration, be prepared to spill almost everything there is to know about yourself.

As White House chief of staff, Rahm Emanuel will have a say in many of the new administration's hiring decisions.

The Obama transition team is sending a seven-page, 63-item questionnaire to every candidate for Cabinet and other high-ranking positions in the incoming administration.

“If you have ever sent an electronic communication, including but, not limited to an email, text message or instant message that could suggest a conflict of interest or be a possible source of embarrassment to you, your family, or the president-elect if it were made public, please describe.”

The questions cover everything from information on family members, Facebook pages, blogs and hired help to links to Fannie Mae, Freddie Mac, American International Group and troubled banks as well as lawsuits, gifts, resumes, loans and more.The transition team has about 7,000 positions to fill, according to the U.S. Government Printing Office's Plum Book, the quadrennial list of positions subject to presidential appointment.

Under the final, "Miscellaneous" category, the questionnaire asks for the names and phone numbers of past live-in lovers; whether anyone in the applicant's family owns a gun; the state of the applicant's health; and whether he or she has any enemies

Posted by

MRENTERTAINMENT

at

12:19 AM

0

comments

![]()

![]()

Part Two White People Buying Guns Since Last WED

Watch the clip..This guy is nuts..I hope that gun melts in his hand....The guns on Fire if you look close...

Posted by

MRENTERTAINMENT

at

12:13 AM

0

comments

![]()

![]()

Thursday, November 13, 2008

White People Buying Guns At A Alarming Rates Since Last Week

White people, primarily in the south, are purchasing guns at an alarming rate. Some articles try to downplay the reality of racism as the reason for this arms buildup in the south by saying these people fear that Democrats will ban guns. Supposedly, this impending ban on guns is the reason they're going to buy them now, before Obama gets sworn in as the 44th President of the United States.

In One day a gun shop owner sold $100,000 in guns in the state of Texas.

Posted by

MRENTERTAINMENT

at

11:40 PM

0

comments

![]()

![]()

Tuesday, November 4, 2008

Friends In The City

If you are tired of not making a connection with anyone or if your only weekend option is nightclubs, or if you are new to the AREA and want to make a connection with friends. This club is targeting ages 28 and older. The club is for socializing and networking with people in the DMV. If you are interested in watching Football, Basketball, having bowling parties, movie nights, Meeting for happy hours, Book clubs, weekend getaways, Club Night, BBQs, fight parties, dinner parties, card game night parties, Concert outtings, Debate nights, Ski trips, Formal Dinner nights, Couple nights, etc., THIS IS THE CLUB FOR YOU!!!

If you are interested contact us at friendsinthecity@gmail.com

SOMETHING NEW SOMETHING DIFFERENT

Posted by

MRENTERTAINMENT

at

7:53 PM

0

comments

![]()

![]()

Labels: DMV, Social Club

Sunday, October 26, 2008

$2200 Puts you in the top 50% of Rich People Worldwide...Count your blessings

$2200 Puts you in the top 50% of Rich People Worldwide...Count your blessingsAdd your rating: Currently 0/5 stars. 1 2 3 4 5 Rating: No Rating Posted by Siren on October 21, 2008 at 10:12am

SANTA MONICA, Calif. (MarketWatch) -- The richest two percent of the world's population owns more than half of the world's household wealth.

Although you may believe you've heard this statistic before, you haven't: For the first time, personal wealth, not income, has been measured around the world. And the findings are surprising. For what makes people "wealthy" across the world spectrum is a relatively low bar.

The research finds that assets of just $2,200 per adult placed a household in the top half of the world's wealthiest. To be among the richest 10% of adults in the world just $61,000 in assets is needed. If you have more than $500,000, you're part of the richest 1%, the United Nations study found. Indeed, 37 million people now belong in that category.

Sure you can now be proud that you're rich. But take a moment to think about it and you'll probably come to realize the meaning behind these numbers is harrowing. For if it takes just a couple of thousand dollars to qualify as rich in this world, imagine what it means to be poor.

Half the world -- nearly three billion people -- live on less than two dollars a day. The three richest people in the world have more money than the poorest 48 nations -- combined.

Even relatively developed n

nations have low thresholds of per-person capital. For example, people in India have per capita assets of $1,100, and in Indonesia capital amounts to $1,400 per capita.

The study's authors defined net worth as the value of people's physical and financial assets, less debts.

"In this respect, wealth represents the ownership of capital. Although capital is only one part of personal resources, it is widely believed to have a disproportionate impact on household well-being and economic success, and more broadly on economic development and growth," they say.

That said, it's interesting to take a look at how different economic levels manage their capital.

Property, particularly land and farm assets, are more important in less developed countries because of the greater importance of agriculture and because financial institutions are immature.

The study also reveals the differences in the types of financial assets owned. Savings accounts are strongly featured in transition economies and in some rich Asian countries, while stock and other types of financial products are more commonplace in Western nations.

The authors say there is a stronger preference for saving and liquidity in Asian countries because of lack of confidence in financial markets. That isn't so much the case in the U.S. and the United Kingdom, which have private pensions and more developed financial markets, they say.

Debt doesn't weigh Surprisingly, household debt is relatively unimportant in poor countries because, the study says, "While many poor people in poor countries are in debt, their debts are relatively small in total.

This is mainly due to the absence of financial institutions that allow households to incur large mortgage and consumer debts, as is increasingly the situation in rich countries"

Meanwhile, "many people in high-income countries have negative net worth and -- somewhat paradoxically -- are among the poorest people in the world in terms of household wealth."

But let's not feel too bad about ourselves, even if we do have a negative savings rate.

The average wealth is the U.S. is $144,000 per person. In Japan, it's $181,000. Overall, wealth is mostly concentrated in North America, Europe and high income Asia-Pacific countries. People in these countries collectively hold almost 90% of total world wealth.

The world's total wealth is valuated at $125 trillion. And although North America has only 6% of the world adult population, it accounts for 34% of household wealth.

So be grateful for where you live in the world; it directly correlates to how much you have. But don't bask in superiority: The fastest-growing population of wealthy people is in China.

Look out when they transition from saving to spending. It's going to change the composition of the world economy dramatically, and it may just help prevent the world from becoming more of an aristocracy than it already is.

Posted by

MRENTERTAINMENT

at

9:50 PM

0

comments

![]()

![]()

Sunday, September 21, 2008

75 best foods to keep you in the fat-burning zone

Cut out the starchy carbs. Forget the grains. Focus on Meat, Leaves, and Berries for feedings.

Nothing to eat? So, we came up with a non-all-inclusive yet comprehensive list of foods that fall under “Meat, Leaves, and Berries”, and therefore are good to eat to maintain a fat-burning environment in your body (of course, some are better than others and we highlight these nutritional superstars in our book, The Black Book of Secrets).

Here, in no particular order, are the first 50 foods we could think of that count as a “Meat”, a “Leaf”, or a “Berry.”

Red Meat (grass-fed is best):

1) Beef (includes the ground-up stuff. Hamburger without the bun, anyone?)

2) Lamb

3) Bison

4) Ostrich (yes, ostrich. Come to think of it, Kangaroo and Emu are pretty damn tasty too)

5) Venison (or other wild game)

Poultry (free-range is best):

6) Turkey

7) Chicken

8) Duck

9) Wild fowl like squab, quail, pheasant, etc.

10) EGGS (one of the all-stars right here)

Pork:

11) Pork Chops/tenderloin

12) Bacon (yes, bacon! Don’t go eating 10 packs in one sitting, but from time to time it’s fine)

13) Ham (especially prosciutto – however, avoid most mainstream processed deli meats as they are high in salt and potentially harmful preservatives)

14) Sausage (One of Mike’s favorites; don’t overindulge - again, use common sense and exercise control)

Fish and Seafood:

15) Wild salmon (avoid farm-raised if you can as they are high in inflammatory Omega-6 fatty acids)

16) Mackerel

17) Sardines (get the ones packed in sardine oil for maximum Omega-3 content; avoid the ones packed in vegetable oil at all costs)

18) Tuna

19) Shrimp

20) Mollusks (clams, mussels, scallops, oysters, etc.)

“Leaves” (packed with fiber):

21) Arugula

22) Asparagus

23) Beets

24) Broccoli

25) Brussels sprouts

26) Cabbage

27) Carrots

28) Cauliflower

29) Celery

30) Green beans

31) Kale

32) Leeks

33) Mushrooms

34) Onions

35) Peppers

36) Spinach

37) Squash

38) Swiss chard

39) Watercress

40) Snow peas

41) Garlic

42) Zucchini

43) Cucumbers

44) Endive

“Berries”:

45) Blueberries

46) Cranberries

47) Blackberries

48) Strawberries

49) Raspberries

50) Goji Berries (by now you can tell that anything with “berry” as the descriptor is likely a berry)

After listing these 50 foods we realized there were quite a few others that didn’t strictly fall into “meat, leaves, and berries” but were ok nonetheless. (BTW, you get a downloadable food chart and our special report, The Dark Side of Dieting when you subscribe to our weekly newsletter, free) They are listed here:

Other awesome fruit (eat in moderation due to higher sugar content):

51) Apples (especially green apples)

52) Grapefruit

53) Avocado

54) Kiwifruit

55) Watermelon

56) Honeydew

Nuts (eat in moderation due to high calorie density; they work excellent as between-meal snacks):

57) Almonds

58) Walnuts

59) Brazil nuts

60) Cashews

61) Macadamia nuts

62) Pecans

63) Sesame seeds

Fats (use in moderation due to high calorie density, but don’t be scared of using them!):

64) Butter (or it’s clarified cousin, ghee)

65) Flaxseed oil (use on salads)

66) Extra virgin olive oil (high in Omega-3s, but don’t cook with it.)

67) Coconut oil (use this or ghee to cook with)

68) Fish oil (Carlson’s Oil rocks – it has a light, lemony flavor)

Dairy (obviously avoid if you’re lactose intolerant):

69) Full-fat yogurt (low-fat and fat-free contain too much sugar)

70) Cheeses (real ones, not “pasteurized cheese products” or “cheese food”)

71) Cottage cheese

Other:

72) Whey protein isolate (great for pre/post workout nutrition)

73) Flax seeds (grind these up and add to salads, yogurt, cottage cheese for fiber)

74) Green foods/phyto foods (optimize pH, purify your cells, and get a boatload of enzymes and antioxidants while you’re at it)

75) Green tea (your antioxidant/metabolic-accelerator solution)

So there you have it – a non-all-inclusive yet comprehensive list of 75 foods you can eat and still maintain a fat-burning environment in your body. I’m sure you can pick 12 or 13 foods you like out of the 75 and create a dizzying array of menus and meals for the week around them. Remember, we didn’t even mention spices and seasonings, nor preparation methods. You can create literally thousands of combinations.

Posted by

MRENTERTAINMENT

at

10:43 PM

0

comments

![]()

![]()

Labels: FAT BURNER

Thursday, September 11, 2008

Iverson Home 4 Sale/Rasheed Wallace Home 4 Sale

Click on title to see pics of home.

Today is the latest in a long series of sports star homes lingering on the market. Denver Nuggets guard Allen Iverson has been looking to sell his home in Villanova, Pennsylvania for a year now. I first heard about it last year when the Wall Street Journal's Private Properties column first reported on it.

Now a year later the same column reveals that Iverson has dropped the price on the 14,000 square foot home to a desperation price of $4 million. That's $1 million less than the former Philadelphia 76er and his wife Tawanna paid for it in 2003. The six-bedroom home is on four acres that include a pool house, stream and waterfall.The chateau-style home on Chateau Lane has four levels including a great room with floor-to-ceiling Palladian windows.

The master suite has his and hers marble bathrooms, a coffee bar, media area and a veranda overlooking the grounds. There are four additional en-suite bedrooms and a separate guest quarters with a bedroom, living room and kitchenette. The entertainment level has a 12-seat movie theater, billiard room, and a lounge with a custom wood carved bar accommodating 200+ wine bottles. It is now listed at $3.999 million.

Continuing my look at sports star homes lingering on the market, this week's WSJ Private Properties column also mentioned the home of Rasheed Wallace, a Detroit Pistons forward who played for eight years with the Portland Trail Blazers. Wallace bought his 1924 brick house in Portland, Oregon for around $3 million back in 2000. The Tudor-style home is on 2.16 acres that include a pool, sports court and guest house.

The five-bedroom home has a red home theater, built-in saltwater fish tank, home office and more. The listing agent told the WSJ that Wallace and his wife Fatima spent more than $1 million on improvements.

The couple briefly listed the house in 2006 for $5.5 million before relisting it last year, for $5.2 million and have now lowered the price to $4.895 million.

The View is the worst show on the air..I don't blame her for coming with a list of questions they could not ask..Like the time Brandy was on there and they wanted to see her tattoos and wanted to know if her hair was real....Get out of here....

Rosey should have beat that ass....

Black Enterprise names 20 best places to retire

By DAVID PITT – 1 day ago

The magazine, the most recent national publication to release a list of desirable retirement spots, considered a number of factors when tabulating its annual list of Durham, N.C., has topped the list of Black Enterprise magazine's 20 best places to retire, based on quality of life, affordable health care and other considerations."20 Best Places to Retire" in the October issue.

The other top seven locations — Charlottesville, Va., Ann Arbor, Mich., Nashville, Tenn.; Lexington, Ky.; Roswell, Ga. and Columbia, Mo. — also received the magazine's best score for quality of life, which included housing prices, public schools, crime levels, traffic congestion and commercial air access.The rankings, in a survey created by the magazine's editors, gave places 40 percent of the total score for quality of life, 20 percent for health care, and 15 percent each for taxes and leisure. Arts & Culture and climate were each given 5 percent of the total score.

Many of the 20 locations are in the South, where the climate can be milder, although a few locations are in the Upper Midwest or Northeast, which received high scores for quality of life but lower marks for climate.

Editor-In-Chief Derek Dingle said the goal was to present readers retirement options with high quality of life standards, quality health care and low taxes so they could stretch their retirement nest egg further.In addition, many of the cities are near metropolitan areas with access to historically black colleges and universities "where they can engage in leisure and arts and cultural activities, areas for our audience that had some African American orientation."

Black Enteprise magazine has about 525,000 paid subscribers and 4 million readers, predominantly African Americans. Entrepreneurs and business owners make up than a third of the readership.

Other publications highlight factors such as affordability and desirability of locales in making their own assessments of possible retirement spots.

Money Magazine, in its report, broke up retirement destinations by category, including a group of six towns on the water: Dunedin, Fla.; Sequim, Wash.; St. Joseph, Mich.; Beaufort, S.C.; Durango, Colo.; and Marble Falls, Texas.Money also has a list of places for most affordable homes and those towns in which you can expect to live a long life, including two counties in Iowa and two in Minnesota. Locations in Maryland, Florida, Oregon, Virginia, California and Hawaii also made Money's list.

U.S. News & World Report highlighted locations ranging from Bozeman, Mont., which tops its list, to Concord, N.H., Fayetteville, Ark. and Hillsboro, Ore.

Research by the AARP, a nonprofit organization for people age 50 and older, indicates that a large majority of retirees won't move at all, and if they do, they likely won't go far.

In a 2006 study based on more than 1,200 interviews and Census data, the AARP said nine out of 10 people 60 and older stayed in the same home or within the same county.

Nancy Thompson, a spokeswoman for AARP, said retirees should keep several factors in mind when contemplating a move, including whether a home as a no-step entry and bedroom on the main floor, in case a person should become less mobile, as well as access to public transportation and walkable pathways in the community should the person become unable to drive.

Posted by

MRENTERTAINMENT

at

6:48 PM

0

comments

![]()

![]()

Tuesday, September 9, 2008

Anyone For Donkey Milk???

Where did I get this from? I was watching the Discover network with Andrew Zimmerman.

He is known to eat Donkey Meat...He said it taste like Pot Roast LOL!...But today he walking down the street and This guy was selling fresh warm Donkey Milk pulled from the Donkey right before your eyes LOL!And he said it was still warm and tasted good..

He said he was Liquid Viagra....

Donkey's Milk Coming to the US...

"Just so you know, donkey's milk is coming to the US! Raw donkey milk is going great guns in France and Belgium. Marie Tack in Belgium sells donkey milk that meets European bacteriological standards.I visited two farms in France and drank milk directly from many burros (delicious!). I will go to Belgium next year to visit Marie myself who milks 50 head of mammoth jennets each day. Donkey milk is the closest milk to human breast milk and is ideal for feeding infants. It is in a state of rediscovery in France and Belgium and will be available here in the future. Donkeys don't carry bovine diseases. Visit www.asineriedupaysdescollines.be to see her operation."

It remains to be seen whether this will catch on in the United States and if the milk will be offered unpasteurized. Readers who have additional information about donkey milk in the US, please email the Weston A. Price Foundation at info@westonaprice.org.

Posted by

MRENTERTAINMENT

at

8:20 PM

0

comments

![]()

![]()

2009 Maserati GranTurismo S: An Italian Virtuoso

This is a short clip of the 2009 Maserati...I love this car! When I hit the Lottery I am going to get that joint in Red....Enjoy the video!!

Posted by

MRENTERTAINMENT

at

2:25 PM

0

comments

![]()

![]()

Monday, September 8, 2008

Chocolate City Travel & Entertainment Presents...

4th Annual No Sleep Ski Weekend

Lloyd Calling All Girls Around the World to the Inn @ Pocono Manor

February 27 - March 1, 2009

Don't miss this trip...

It can't get no better than this... 17 hours open bar...

In plus you get your own bottle for the room of your choice...

Prices start at $339/pp...

Call us now, payments being accepted now and payment plans in effect

I guess this should be a great party...

Money Monday: 5 Ways to Boost Your Credit Score

Posted by TheDad on September 8th, 2008 in Debt and Dating, Home

Your credit score is one of the most important factors in your financial life. The current recession makes it even harder for consumers to get approved for a loan or line of credit which is why it is so crucial to have good credit.

If you have good credit and can afford to make purchases during this time you can get some great deals. However, if you are already in debt, don’t have an emergency fund, savings account or retirement account you need to reevaluate your spending habits. While you are working on improving your spending habits you can also follow these 5 tips to boost your credit score so when the time is right you can make a purchase and get the best deal possible.

1. Change your mindset. You have to change the way your currently spend money and develop good spending habits so you make good choices when making purchases, buy in terms of needs vs. wants.

2. Get current on late bills. Pay old or late accounts immediately. Setup payment plans for bills that cannot be paid in full.

3. Establish credit. Open a secured account if you have bad credit or no credit to re-establish credit history. Use non-traditional forms of credit to establish history such as Pay Rent Buy Credit (Payment Reporting Builds Credit), www.pbrc.com.

4. Keep balances low. Keep your credit card balances at 50% or below the credit limit. This shows you have good spending habits are not seen as a credit risk.

5. Don’t open new accounts. Don’t open any new accounts more than once every year when trying to improve your credit history. You will be seen as a credit risk and this will lower your credit score.

This is another guest post installment by author and financial expert Harrine Freeman. Be sure to check back next Monday for another.

Posted by

MRENTERTAINMENT

at

5:50 PM

0

comments

![]()

![]()

Labels: 720 Credit Score

Week One Of The NFL

Week One OF The NFL Season WOW!!!

I think we the Pats will still make the playoffs due to there week schedule...

I think some teams will return to there orginal form.The Falcons were a big surprise

I think they turn back to there old self I think they go 8-8.

I think the Redskins will suck as always....The Bengals will have a down year thier teams looks bad...The wideouts look bad also...They have a hard schdeule this year also.Now I think Pittsburg Steelers may be on the up and Up..I think that the Superbowl will come down to Chrgers Vs Dallas..

The Bears may be back also they looked good this past Sunday...

The Rams look bad....WOW....The chiefs hey maybe we are not that bad....

Posted by

MRENTERTAINMENT

at

5:15 PM

0

comments

![]()

![]()

Sunday, September 7, 2008

Culpepper

Posted by

MRENTERTAINMENT

at

9:02 PM

0

comments

![]()

![]()

Tom Brady Season Done

Tom Brady has a torn MCL and ACL 8 month recovery..I think they call Culpepper he has played with Randy Moss..You heard it here first.....This happnen in week one its 15 more weeks to go...

Donte Drop The Hamburger

Posted by

MRENTERTAINMENT

at

8:20 PM

0

comments

![]()

![]()

Friday, September 5, 2008

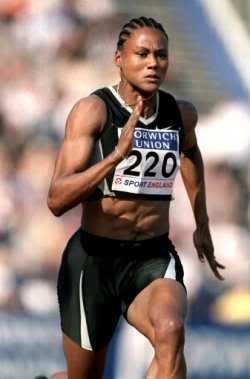

Breaking News Marion Jones Out Of Halfway House

SAN ANTONIO - Disgraced sprinter Marion Jones was released Friday from federal prison after completing most of her six-month sentence for lying about her steroid use.

Jones left a halfway house in San Antonio around 8 a.m., said LaTanya Robinson, a community corrections manager for the federal Bureau of Prisons. Jones, who has a house in Austin, will remain on probation.

Jones' attorney did not immediately respond to a call or e-mail from The Associated Press requesting comment.

The sprinter admitted last October that she used a designer steroid known as "the clear" from September 2000 to July 2001. The drug was linked to the Bay Area Laboratory Co-Operative, the lab that became the center of a steroids scandal that touched numerous professional athletes, including baseball star Barry Bonds

I am sure she happy shes out I am happy for her.Not sure where she goes from here though can not return to the running I dont think.After seeing how the women from the us ran this year she might be on the same level...

Posted by

MRENTERTAINMENT

at

3:19 PM

0

comments

![]()

![]()