Man Dies After His Wife Set His Genitals On Fire For Cheating.This lady burn down a Million Dollar house and sets her husband Manhood on fire....WOW...WOW...

The American Gangster By Louis Farrakhan

Must listen to this real talk!!!!

Tuesday, December 30, 2008

Louis Farrakhan,

Posted by

MRENTERTAINMENT

at

9:14 AM

0

comments

![]()

![]()

Saturday, December 27, 2008

Wednesday, December 24, 2008

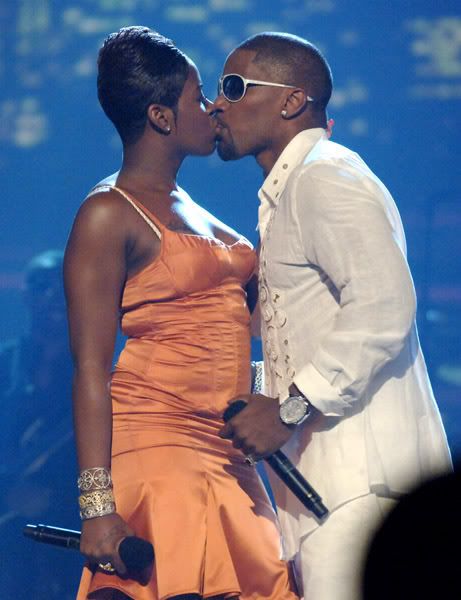

XMAS EVE!!!-Nelly,Can I Buy You A Drink?,

World's Oldest Cognac for $6,000 a Shot

The luxe Lanesborough Hotel in London has just acquired the world's oldest bottle of cognac, distilled in 1770, and is offering it to patrons of their plush Library Bar (above) for £4,000, or about $6,000, per shot. That's considerably more than the ultra-expensive Louis XIII Black Pearl Magnum cognac my colleague Lisa Palladino wrote about last summer, which cost $2,500 per shot. In addition to the 240-year-old tipple, the Lanesborough, a St. Regis property, just installed a new walk-in cigar humidor, the first of its kind in a London hotel. The humidor houses 1,000 cigars and contains 25 private lockers for the personal collections of top patrons, who can enjoy Cuban and even pre-Castro smokes in the hotel's posh Garden Room.

[via JustLuxe]

Sources say that Nelly likes it and wants to put a ring on it, but Ashanti’s mom-ager is c*ckblocking all the time.

“Tina sticks her nose in everything because she’s also Ashanti’s manager...She’s always pushing Ashanti to make more money, to always look great. It stresses her out, and Nelly doesn’t like that..."Before he makes her his wife,” adds the source, “Nelly wants to know that Ashanti can make decisions on her own.

If Ashanti knows what's up, she will put that independent act together real quick, because no dude wants a chick that's still hanging off her moms' melons.

I need the money????

Guy Breaks His Leg!!!!!!!!

Merry X-Mas

Posted by

MRENTERTAINMENT

at

8:38 AM

0

comments

![]()

![]()

Tuesday, December 23, 2008

Oprah Moving To D.C.???

Oprah the talk show titan is reportedly looking at ultra-luxury properties in Washington, DC; something suitable for, say, possible consultations with the President of the United States.

Insiders tell the New York Post that Winfrey's people have been scouting a nine-bedroom mansion in D.C.'s swanky Georgetown neighborhood with a whopping price tag of $50 million.

"She has never personally been to see it," another source tells the paper.

But FOXNews.com has researched listings in the area and found a single house that fits that description: a $49 million, nine-bedroom, four-bathroom mansion on three-and-a-half acres with parking for 100 cars, a gatehouse, and an additional building overlooking the Washington monument.

In case of parties..

Posted by

MRENTERTAINMENT

at

11:42 PM

0

comments

![]()

![]()

Monday, December 22, 2008

LAMAR'S BIRTHDAY WEEKEND

This is a recap of the weekend...One of my best Birthday party weekends in years.

Friday hit Club Love which is my All-Time favorite party spot in the world...Sat we hit Club Lux which was a smaller version of Love and it was cool..Parking was not the best...

Sunday we had Dinner at one of Washington D.C.'s premier restaurants for over 20 years. Located in the heart of historic Georgetown, Filomena Ristorante offers outstanding Italian cuisine and elegant atmosphere.Very nice spot voted number

one Italian Restaurant in the DMV.

P.S. Thanks to my all time two best party people in the world.Shanda and Che AKA "RED BULL"..

Check out a few pics..

Posted by

MRENTERTAINMENT

at

10:51 AM

0

comments

![]()

![]()

Sunday, December 21, 2008

BMF,P Diddy-J-LO,Jamie Foxx

J-LO

The word is that J-Lo’s four year marriage to Marc Anthony may be on the rocks as she's been seen gallivanting around Los Angeles' social scene without her wedding ring. Marc has been spotted out and about flirting with other women and talking smack about marital misery…ringless as well.

Insiders say she is becoming increasingly frustrated with Marc’s “controlling” nature - he insists on picking her clothes and checks up on all her phone calls. Anthony has denied the rumors and says that their marriage is doing just fine….hmmmm we’ve all heard that before.

I am sure P Diddy waiting in the wings in his Sunday's best for this break up..

Stripper Down!!!

FLASHBACK INTERVIEW JAMIE FOXX-SUPERHEAD!!!!!!!!!!!WOW !!

Posted by

MRENTERTAINMENT

at

10:59 AM

0

comments

![]()

![]()

Saturday, December 20, 2008

Posted by

MRENTERTAINMENT

at

8:43 PM

0

comments

![]()

![]()

Friday, December 19, 2008

Sunday, December 14, 2008

Michael-Vick-R_0[1]

By ALAN JUDD

The Atlanta Journal-Constitution

Saturday, December 06, 2008

The day he went to jail, Michael Vick bought a $99,000 Mercedes.

RELATED STORIES

Records show how Vick burned through fortune

Vick enters guilty plea, gets suspended sentence

Vick to enter guilty plea in Va. court Tuesday

Vick back in Virginia to face state charges

He cashed four checks that totaled $24,900. He gave $28,000 to the mother of his oldest child. He paid a public relations firm $23,000 and gave a friend $16,000.

Altogether on Nov. 19, 2007, Vick spent $201,840. But for the former Atlanta Falcons quarterback, the day was most remarkable for how it ended: behind bars, beginning what would be a nearly two-year sentence in a notorious dogfighting case.

The day’s spending, in fact, was but a small part of the $18.2 million that flew out of Vick’s hands from 2006 to 2008, according to documents filed recently in U.S. Bankruptcy Court in Norfolk, Va. Nearing the end of his time in federal prison, Vick, 28, is seeking the court’s protection from his creditors.

They are particularly interested in his increased spending in the three months before he reported for jail.

The documents provide a detailed look at the privileged lifestyle of an athlete who rarely offered more than a glimpse of himself off the playing field. They show how Vick, who grew up poor in Newport News, Va., bought houses and cars, farms and horses, boats and jewelry, all at the height of a spectacular career that shattered after he was identified as the key figure in an illegal dogfighting ring.

The bankruptcy filings also reveal Vick at his most vulnerable. Financial advisers, Vick’s lawyers claim, took advantage of him. He poured money into businesses that failed. He took care of the needs of his relatives, paying for satellite television and cellphone service, for instance, and his mother’s offerings to her church. He even gave each of his three co-defendants in the dogfighting case $150,000 for legal bills.

For his own expenses, Vick seems to have relied heavily on cash.

In 2007, documents show, he used cashier’s checks to withdraw $908,500 from his bank accounts. During a two-year period, he wrote checks payable to “cash” totaling almost $1.1 million.

His spending escalated as his prison sentence neared.

From Aug. 27, 2007, the day he pleaded guilty in a Richmond federal courthouse, until Nov. 19, the day he bought the new Mercedes before reporting to jail, Vick shelled out $3,627,291.

Those transactions are “of special interest” to groups seeking repayment from Vick, said attorney Ross Reeves of Norfolk, who represents unsecured creditors, including the Falcons. The team wants Vick to return $3.75 million from a 2004 bonus.

“Where did these assets go and for what purpose?” Reeves said in an interview. “A lot of what Mike Vick was doing was planning for being incarcerated. He wanted to provide for his family, and he made that clear.”

At the same time, Reeves said, creditors want to make sure Vick wasn’t “sheltering assets.”

Lawyers for Vick declined to comment.

Whatever the case, everything Vick had may be gone. And resuming his old life when he gets out of prison next year seems a long shot.

Vick is banned from the National Football League. Once the game’s highest-paid player, Vick now claims only a nominal monthly income from an investment account: $12.89.

‘World is mine’

Not long after joining the Falcons, Vick bought his first house: a $918,000 mini-mansion behind the gates that guard the Sugarloaf Country Club in Duluth. Two years later, in April 2005, he upgraded to a larger house in the same neighborhood, for almost $3.8 million. Among his improvements to that property: a movie screening room and a golf simulator.

Vick had money to burn. In 2004, after two seasons with the Falcons, he signed a new contract that, with potential bonuses, could pay him $130 million by 2013. Endorsement deals — with Nike, AirTran Airways and others — added millions more. In 2006 and 2007 alone, Vick took in almost $22 million.

So, court records show, Vick went shopping.

He bought four more houses, all in Virginia, and began building another.

He bought a condominium in Miami Beach.

He bought interests in two farms — one in Virginia, one in Rockdale County, east of Atlanta.

He bought six Paso Fino horses, worth about $450,000.

He bought two boats, one for $100,000, the other for $125,000.

He bought cars: a Bentley, two Land Rovers, Cadillacs, an Infiniti sport utility vehicle and an Infiniti sedan, two Ford pickup trucks, a Dodge, a Chevrolet, the $99,000 Mercedes.

And he bought as much as $450,000 in jewelry. The pieces included two Swiss watches, a bracelet, a pair of diamond stud earrings, and a charm inscribed, “World is mine.”

Vick shared with family and friends and with family of friends.

In 2006, for instance, he bought his sister, Christina, a GMC Yukon. The next year, he gave a Lincoln Navigator to Tameka Taylor, the mother of his first child. The mother of Vick’s other two children, Kijafa Frink, got a Land Rover; her mother, a Cadillac Escalade.

Vick also took on recurring obligations. He paid Frink’s mortgage and gave her $1,000 a month for clothes, court records say, and $300 for “beauty-related expenses.” He supported Taylor and their son with $3,500 a month.

For his mother, Brenda Boddie, Vick covered a $4,700-a-month mortgage and $2,100 in payments for her two Cadillacs.

In all, routine monthly bills for the mothers of Vick’s children and for his own mother came to $31,293 — more than $375,000 a year.

Unlucky 7?

To run his complicated financial life, Vick in 2005 created a management and marketing company, MV7 LLC. It provided income for at least two family members, according to public records: Vick’s mother, whose salary approached $100,000 a year, and his sister, who earned about $22,000. The firm even had a retirement fund.

MV7 was the first of several ventures that alluded to one or both of Vick’s most valuable assets: his name and his jersey number.

Divine Seven operated a Payless Car Rental franchise at the Atlanta airport. Seven Charms Farm raised horses. Vicktory Corp. oversaw family investments. Siete (Spanish for “seven”) delivered a gift of $317,000 to his mother’s church a week before Vick pleaded guilty.

Bad luck plagued many of Vick’s enterprises.

In 2006, Vick personally guaranteed a $2.1 million bank loan to Divine Seven in exchange for a 60 percent stake in the company. A little over a year later, the bank declared the loan in default. It obtained a civil judgment against Vick and is trying to collect through his bankruptcy case.

In 2007, Vick put up $200,000 for a 60 percent interest in Seven Charms Farm, a 5-acre spread near Conyers. In September of this year, Rockdale County sold the property at auction to satisfy an unpaid property tax bill. The buyer got the property for $40,000.

Vick’s philanthropic efforts didn’t fare especially well, either. In 2006, the Michael Vick Foundation provided 100 backpacks to poor children in Newport News and paid for an after-school program. But the foundation spent only 12 percent of its budget — $20,590 of $171,823 — on charitable programs, according to its 2006 federal tax return. The foundation paid its fund-raiser, Susan Bass Roberts, a former spokeswoman for Vick, $97,000, the tax return shows.

Most of the foundation’s money came from Vick, Roberts said in an interview. But she declined to speak in detail about the foundation, which she described as “kind of like ancient history.”

The foundation ceased operations in 2006.

Most of the money left in the foundation’s bank account, $50,000, was withdrawn earlier this year by one of the succession of financial advisers Vick hired, court records say. Several advisers and business partners took money or other assets without Vick’s approval, his lawyers told the bankruptcy court, adding that they may file lawsuits to recoup some of his losses. Vick’s former associates have denied the allegations.

Perhaps Vick’s most successful company was the one that precipitated his fall from grace.

Mike Vick Kennels LLC bred and sold pit bulls – and, Vick ultimately admitted in court, staged and participated in illegal dogfights.

A last spree

After a highly publicized investigation that lasted several weeks, a federal grand jury indicted Vick on dogfighting charges on July 17, 2007. He pleaded guilty before U.S. District Judge Henry Hudson five weeks later, on Aug. 27, in Richmond. Hudson let Vick remain free on bond until a hearing on his sentence, scheduled three months out.

Thus began Vick’s last spending spree.

He began by setting aside money for family members. He put $625,000 into two businesses that would make monthly payments to Frink, who then was pregnant with their second child. He also gave Frink $48,000 and an SUV to keep in Leavenworth, Kan., where he would serve his sentence.

During his last weeks of freedom, though, Vick also spent $85,000 on a fish pond and $48,257 for landscaping. He bought a $31,000 Ford pickup and a $33,100 Chevrolet.

Vick’s financial records suggest he was hemorrhaging money. In the weeks before he went to jail, he made 48 cash withdrawals for a total of $325,945. The largest was on Sept. 19, for about $67,000. Using three cashier’s checks, he withdrew an additional $90,000.

Court documents do not reflect how Vick used the cash.

Finally, on Nov. 19, Vick went to a car showroom in Hampton, Va. He picked out an andorite-gray 2008 Mercedes-Benz S550 sedan and, using his bank debit card, paid in full: $99,589.71.

Then he drove to Richmond, surrendered to federal marshals and went to jail.

The Mercedes now is in the hands of a group of creditors; they recently told a bankruptcy judge they have found a buyer willing to pay $65,000. A luxury-car broker is trying to sell the rest of Vick’s vehicles.

Under bankruptcy laws, Vick will be allowed to retain ownership of one house; he chose his mother’s home in Suffolk, Va. He also is keeping $136,500 of home furnishings, $5,000 of clothes and a retirement account with a balance of $96.63.

Vick’s other houses are on the market. The proceeds of any sales would go toward paying off the mortgages.

Repaying other creditors might be a challenge, especially if his suspension from professional football continues after his prison term.

In addition to his other debts, Vick owes more than $1.2 million in back taxes, the Internal Revenue Service told his bankruptcy judge last month. That figure may increase, the IRS said in court papers; Vick has not yet filed his 2007 return.

Still, Vick’s court papers sound an upbeat note.

After prison, his lawyers wrote last month, Vick “will return to Virginia and will seek to rebuild his life and his career.”

Vick, they wrote, has “every reason to believe that upon his release, he will be reinstated into the NFL, resume his career and be able to earn a substantial living.”

Posted by

MRENTERTAINMENT

at

10:41 PM

0

comments

![]()

![]()

Mike Vick Was Ballin!!!!!!!!!!!!!!

Records show how Vick burned through fortune

By ALAN JUDD

The Atlanta Journal-Constitution

Saturday, December 06, 2008

The day he went to jail, Michael Vick bought a $99,000 Mercedes.

RELATED STORIES

Records show how Vick burned through fortune

Vick enters guilty plea, gets suspended sentence

Vick to enter guilty plea in Va. court Tuesday

Vick back in Virginia to face state charges

He cashed four checks that totaled $24,900. He gave $28,000 to the mother of his oldest child. He paid a public relations firm $23,000 and gave a friend $16,000.

Altogether on Nov. 19, 2007, Vick spent $201,840. But for the former Atlanta Falcons quarterback, the day was most remarkable for how it ended: behind bars, beginning what would be a nearly two-year sentence in a notorious dogfighting case.

The day’s spending, in fact, was but a small part of the $18.2 million that flew out of Vick’s hands from 2006 to 2008, according to documents filed recently in U.S. Bankruptcy Court in Norfolk, Va. Nearing the end of his time in federal prison, Vick, 28, is seeking the court’s protection from his creditors.

They are particularly interested in his increased spending in the three months before he reported for jail.

The documents provide a detailed look at the privileged lifestyle of an athlete who rarely offered more than a glimpse of himself off the playing field. They show how Vick, who grew up poor in Newport News, Va., bought houses and cars, farms and horses, boats and jewelry, all at the height of a spectacular career that shattered after he was identified as the key figure in an illegal dogfighting ring.

The bankruptcy filings also reveal Vick at his most vulnerable. Financial advisers, Vick’s lawyers claim, took advantage of him. He poured money into businesses that failed. He took care of the needs of his relatives, paying for satellite television and cellphone service, for instance, and his mother’s offerings to her church. He even gave each of his three co-defendants in the dogfighting case $150,000 for legal bills.

For his own expenses, Vick seems to have relied heavily on cash.

In 2007, documents show, he used cashier’s checks to withdraw $908,500 from his bank accounts. During a two-year period, he wrote checks payable to “cash” totaling almost $1.1 million.

His spending escalated as his prison sentence neared.

From Aug. 27, 2007, the day he pleaded guilty in a Richmond federal courthouse, until Nov. 19, the day he bought the new Mercedes before reporting to jail, Vick shelled out $3,627,291.

Those transactions are “of special interest” to groups seeking repayment from Vick, said attorney Ross Reeves of Norfolk, who represents unsecured creditors, including the Falcons. The team wants Vick to return $3.75 million from a 2004 bonus.

“Where did these assets go and for what purpose?” Reeves said in an interview. “A lot of what Mike Vick was doing was planning for being incarcerated. He wanted to provide for his family, and he made that clear.”

At the same time, Reeves said, creditors want to make sure Vick wasn’t “sheltering assets.”

Lawyers for Vick declined to comment.

Whatever the case, everything Vick had may be gone. And resuming his old life when he gets out of prison next year seems a long shot.

Vick is banned from the National Football League. Once the game’s highest-paid player, Vick now claims only a nominal monthly income from an investment account: $12.89.

‘World is mine’

Not long after joining the Falcons, Vick bought his first house: a $918,000 mini-mansion behind the gates that guard the Sugarloaf Country Club in Duluth. Two years later, in April 2005, he upgraded to a larger house in the same neighborhood, for almost $3.8 million. Among his improvements to that property: a movie screening room and a golf simulator.

Vick had money to burn. In 2004, after two seasons with the Falcons, he signed a new contract that, with potential bonuses, could pay him $130 million by 2013. Endorsement deals — with Nike, AirTran Airways and others — added millions more. In 2006 and 2007 alone, Vick took in almost $22 million.

So, court records show, Vick went shopping.

He bought four more houses, all in Virginia, and began building another.

He bought a condominium in Miami Beach.

He bought interests in two farms — one in Virginia, one in Rockdale County, east of Atlanta.

He bought six Paso Fino horses, worth about $450,000.

He bought two boats, one for $100,000, the other for $125,000.

He bought cars: a Bentley, two Land Rovers, Cadillacs, an Infiniti sport utility vehicle and an Infiniti sedan, two Ford pickup trucks, a Dodge, a Chevrolet, the $99,000 Mercedes.

And he bought as much as $450,000 in jewelry. The pieces included two Swiss watches, a bracelet, a pair of diamond stud earrings, and a charm inscribed, “World is mine.”

Vick shared with family and friends and with family of friends.

In 2006, for instance, he bought his sister, Christina, a GMC Yukon. The next year, he gave a Lincoln Navigator to Tameka Taylor, the mother of his first child. The mother of Vick’s other two children, Kijafa Frink, got a Land Rover; her mother, a Cadillac Escalade.

Vick also took on recurring obligations. He paid Frink’s mortgage and gave her $1,000 a month for clothes, court records say, and $300 for “beauty-related expenses.” He supported Taylor and their son with $3,500 a month.

For his mother, Brenda Boddie, Vick covered a $4,700-a-month mortgage and $2,100 in payments for her two Cadillacs.

In all, routine monthly bills for the mothers of Vick’s children and for his own mother came to $31,293 — more than $375,000 a year.

Unlucky 7?

To run his complicated financial life, Vick in 2005 created a management and marketing company, MV7 LLC. It provided income for at least two family members, according to public records: Vick’s mother, whose salary approached $100,000 a year, and his sister, who earned about $22,000. The firm even had a retirement fund.

MV7 was the first of several ventures that alluded to one or both of Vick’s most valuable assets: his name and his jersey number.

Divine Seven operated a Payless Car Rental franchise at the Atlanta airport. Seven Charms Farm raised horses. Vicktory Corp. oversaw family investments. Siete (Spanish for “seven”) delivered a gift of $317,000 to his mother’s church a week before Vick pleaded guilty.

Bad luck plagued many of Vick’s enterprises.

In 2006, Vick personally guaranteed a $2.1 million bank loan to Divine Seven in exchange for a 60 percent stake in the company. A little over a year later, the bank declared the loan in default. It obtained a civil judgment against Vick and is trying to collect through his bankruptcy case.

In 2007, Vick put up $200,000 for a 60 percent interest in Seven Charms Farm, a 5-acre spread near Conyers. In September of this year, Rockdale County sold the property at auction to satisfy an unpaid property tax bill. The buyer got the property for $40,000.

Vick’s philanthropic efforts didn’t fare especially well, either. In 2006, the Michael Vick Foundation provided 100 backpacks to poor children in Newport News and paid for an after-school program. But the foundation spent only 12 percent of its budget — $20,590 of $171,823 — on charitable programs, according to its 2006 federal tax return. The foundation paid its fund-raiser, Susan Bass Roberts, a former spokeswoman for Vick, $97,000, the tax return shows.

Most of the foundation’s money came from Vick, Roberts said in an interview. But she declined to speak in detail about the foundation, which she described as “kind of like ancient history.”

The foundation ceased operations in 2006.

Most of the money left in the foundation’s bank account, $50,000, was withdrawn earlier this year by one of the succession of financial advisers Vick hired, court records say. Several advisers and business partners took money or other assets without Vick’s approval, his lawyers told the bankruptcy court, adding that they may file lawsuits to recoup some of his losses. Vick’s former associates have denied the allegations.

Perhaps Vick’s most successful company was the one that precipitated his fall from grace.

Mike Vick Kennels LLC bred and sold pit bulls – and, Vick ultimately admitted in court, staged and participated in illegal dogfights.

A last spree

After a highly publicized investigation that lasted several weeks, a federal grand jury indicted Vick on dogfighting charges on July 17, 2007. He pleaded guilty before U.S. District Judge Henry Hudson five weeks later, on Aug. 27, in Richmond. Hudson let Vick remain free on bond until a hearing on his sentence, scheduled three months out.

Thus began Vick’s last spending spree.

He began by setting aside money for family members. He put $625,000 into two businesses that would make monthly payments to Frink, who then was pregnant with their second child. He also gave Frink $48,000 and an SUV to keep in Leavenworth, Kan., where he would serve his sentence.

During his last weeks of freedom, though, Vick also spent $85,000 on a fish pond and $48,257 for landscaping. He bought a $31,000 Ford pickup and a $33,100 Chevrolet.

Vick’s financial records suggest he was hemorrhaging money. In the weeks before he went to jail, he made 48 cash withdrawals for a total of $325,945. The largest was on Sept. 19, for about $67,000. Using three cashier’s checks, he withdrew an additional $90,000.

Court documents do not reflect how Vick used the cash.

Finally, on Nov. 19, Vick went to a car showroom in Hampton, Va. He picked out an andorite-gray 2008 Mercedes-Benz S550 sedan and, using his bank debit card, paid in full: $99,589.71.

Then he drove to Richmond, surrendered to federal marshals and went to jail.

The Mercedes now is in the hands of a group of creditors; they recently told a bankruptcy judge they have found a buyer willing to pay $65,000. A luxury-car broker is trying to sell the rest of Vick’s vehicles.

Under bankruptcy laws, Vick will be allowed to retain ownership of one house; he chose his mother’s home in Suffolk, Va. He also is keeping $136,500 of home furnishings, $5,000 of clothes and a retirement account with a balance of $96.63.

Vick’s other houses are on the market. The proceeds of any sales would go toward paying off the mortgages.

Repaying other creditors might be a challenge, especially if his suspension from professional football continues after his prison term.

In addition to his other debts, Vick owes more than $1.2 million in back taxes, the Internal Revenue Service told his bankruptcy judge last month. That figure may increase, the IRS said in court papers; Vick has not yet filed his 2007 return.

Still, Vick’s court papers sound an upbeat note.

After prison, his lawyers wrote last month, Vick “will return to Virginia and will seek to rebuild his life and his career.”

Vick, they wrote, has “every reason to believe that upon his release, he will be reinstated into the NFL, resume his career and be able to earn a substantial living.”

Posted by

MRENTERTAINMENT

at

10:20 PM

0

comments

![]()

![]()

Friday, December 12, 2008

Tuesday, December 9, 2008

5 Supplements Your Body Needs

Multivitamins

You can make all the protein shakes you want, but if you're not getting the vitamins your body needs to build muscle and other tissue, then you're just wasting your time and money. Even if you think you’re eating right, you may not be getting all the nutrients you need from your diet. Food’s lack of vitamins and minerals can be caused right at the beginning with lackluster soil, poor storage and incorrect processing or cooking.

Overall, taking a daily multivitamin helps prevent a host of problems. For example, Mayo Clinic researchers recommend taking multivitamins to keep sperm healthy. Also, vitamin B controls the energy-level regulator cortisol, which is beneficial if you work in front of a computer all day. Multivitamins are also key to making other supplements work correctly.

Dosage: One multivitamin daily.

Selenium

This powerhouse mineral fights free radicals and, as a result, can be a key player in warding off cancer. Want proof? Research has found that men with high levels of this mineral were 48% less likely to contract advanced prostate cancer. Selenium can also help prevent lung cancer, as demonstrated by tests with groups of smokers taking the supplement. No, this doesn’t mean you’re allowed to put off quitting.

A recent Seattle-based study noted that taking multivitamins is important to supercharging selenium’s cancer-fighting power. This may be due to the fact that multivitamins contain at least 30 international units (IU) of vitamin E, which is the main selenium cofactor. Be sure to keep your ears open for new research developments with this specialized antioxidant, but in the meantime, take selenium for preventive measures.

Dosage: 40 to 70 micrograms (mcg) daily.

Folic acid

It’s not just for prenatal care guys; this B vitamin is a top-notch stroke preventative. At the micro level, it keeps your blood streaming instead of stopping. How? It dissolves homocysteine, a compound linked to heart disease and Alzheimer’s. Studies have shown that men taking large doses of folic acid were 30% less likely to suffer a stroke than those taking just a little.

But that’s not all folic acid does. Recent Dutch studies show that folic acid can increase cognitive function, even in older people. It also helps the body digest, use and synthesize the proteins that boost muscle growth. Folic acid is essential in the production of red blood cells and is helpful in improving energy levels and cardio performance. Finally, folic acid prevents heartburn and replaces lost nutrients in the body, all of which helps the digestive system work properly. You don’t need to overdose on the stuff to reap all the benefits; small amounts taken daily will make all the difference.

Dosage: 400 mcg daily.

Help increase your brain power and your bones

Acetyl-l-carnitine

Rather than helping with a six-pack, this amino acid gets your brain in shape. In fact, acetyl-L-carnitine could possibly slow down the effects of Alzheimer's. And, studies published by Proceedings of the National Academy of Sciences have also shown that rats that took acetyl-L-carnitine did better on memory tests. Why? It looks like carnitine declines in tissues with age, dulling the effectiveness of certain membranes. It’s particularly low in those who get Alzheimer’s. By giving your body the carnitine it’s missing, your mental function will improve, as well as cognition.

On a more fundamental level, Acetyl-L-carnitine is also key to helping the body store and produce energy, and we all know that having a good energy level is key to learning. As with all the other supplements, you don’t have to take a lot to get the maximum benefits. Just make sure your intake is consistent.

Dosage: 100 to 400 mg once daily.

Calcium

This mineral is a master multitasker that builds bones, aids in weight loss and possibly decreases the risk of colon cancer and cholesterol. Studies have found that 1,000 mg of calcium can increase your high-density lipoprotein cholesterol (a good cholesterol) by 7%. It has also been shown that in terms of bone health, calcium is particularly important for men who have already broken a bone. Calcium actually helps prevent you from suffering a break again.

Be sure to combine your calcium intake with vitamin D as directed. It’s just as critical in maintaining bone health and keeping your body healthy. Though sunlight is one of the best ways to get your vitamin D, Harvard researchers claim that north of 40-degrees latitude the sunlight isn’t strong enough to promote vitamin D formation. Recent (and wise) surges in the use of sunscreen also curb this type of vitamin sourcing. So reach for the supplements bottle on this one.

Dosage: 500 mg of calcium citrate with 125 IU of vitamin D twice daily.

Posted by

MRENTERTAINMENT

at

8:03 PM

0

comments

![]()

![]()

BOW SAY'S HE HAS MORE JORDANS THEN ANYBODY...NOT MARCUS JORDAN THOUGH!!

Posted by

MRENTERTAINMENT

at

3:15 PM

0

comments

![]()

![]()